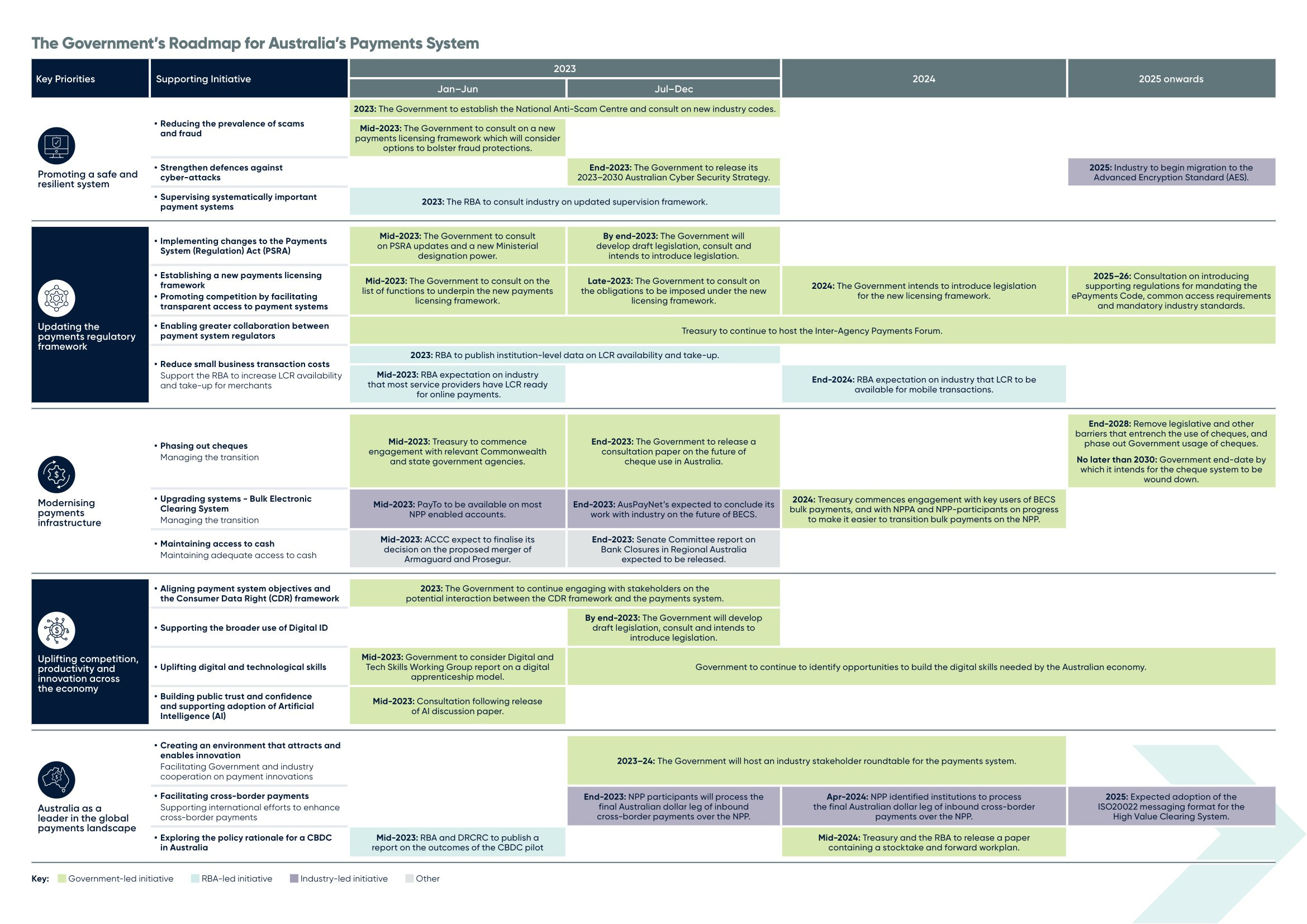

The Australian Government has recently released a strategic plan aimed at building a modern and resilient payments system. This newsletter will provide a summary of the key points from the plan. This time around, there is an increased clarity on the timeline for the various initiatives which provides confidence for businesses in the payments space.

Government's Vision

The Government envisions a modern, world-class, and efficient payments system that is safe, trusted, and accessible. This system will enable greater competition, innovation, and productivity across the economy. The Government is pursuing reforms to ensure our regulatory framework is fit for purpose now and into the future.

Key Priorities and Initiatives

Promoting a Safe and Resilient System: The Government aims to reduce scams and fraud, strengthen defenses against cyber-attacks, and supervise systematically important payment systems.

Updating the Payments Regulatory Framework: Changes will be implemented to the Payment Systems (Regulation) Act (PSRA), a new payments licensing framework for Payment Services Providers (PSPs) will be established, and competition will be promoted by facilitating transparent access to payment systems. The RBA has set an expectation on industry for Least-Cost Routing (LCR) to be available for mobile wallet transactions by the end of 2024.

Modernising Payments Infrastructure: The Government plans to phase out government cheque usage by the end of 2028, with the eventual wind-down of the cheques system in Australia by no later than 2030. A significant part of this modernisation will also involve the transition away from the Bulk Electronic Clearing System (BECS) currently used for electronic funds transfers to the New Payments Platform (NPP).

Uplifting Competition, Productivity, and Innovation Across the Economy: The Government aims to align payment system objectives with the Consumer Data Right (CDR) framework, support the broader use of Digital ID, uplift digital and technological skills, and build public trust and confidence in the adoption of Artificial Intelligence (AI).

Australia as a Leader in the Global Payments Landscape: The Government aims to create a regulatory environment that attracts and enables innovation, facilitate cross-border payments, and explore the policy rationale for a Central Bank Digital Currency (CBDC) in Australia.

The Evolving Payments Landscape

The digital revolution has transformed the way Australians make and receive payments. The pace of change has accelerated in recent years, partly driven by consumer responses to the COVID-19 pandemic. Transactions are shifting from in-person to online forms of shopping, and there is an increasing demand for near-instant and seamless payment experiences.

Increasing Use of Digital Payments

Digital payments have made transactions more convenient and secure. Australians have been fast adopters of these new payment methods. Card-based payments make up about 75% of non-cash retail payments, with 25% of that volume coming via mobile wallets.

International Payments

Australia is a highly active trading nation, with international trade activity being equivalent to almost half the value of total GDP in 2022. Cross-border payments are critical in supporting economic growth and achieving Australia's economic and development goals.

The Government will review and publish an updated strategic plan every 18 months to ensure it remains relevant in the face of changing circumstances.

Stay tuned for more updates..